Blog Related

How Safe Are Credit Card Magnetic Stripe Readers Today?

2025-05-291 | Understanding the Risk Landscape

Many shops still ask customers to "swipe," and the familiar credit card magnetic stripe reader completes the sale in seconds. Yet speed alone no longer equals safety. When you swipe, the reader pulls unencrypted data from the black stripe and forwards it through the payment network. Because that data sits in plain text, criminals need only a moment to copy, relay, or reuse it. Over the last decade regulators have pushed EMV, PBOC, and similar chip-based standards precisely because magnetic data is easy to lift.

Attackers now combine low-tech parts with smart tactics:

• Skimming devices snap onto the reader slot and copy every track on every swipe.

• Micro-cameras hide above the keypad to capture PINs that match skimmed cards.

• Hardware tampering swaps a store's own reader with a doctored twin, collecting data for weeks before anyone notices.

Chargebacks rise, fines follow, and consumer trust fades. As a result, the old credit card magnetic stripe reader that once felt invisible is suddenly the weakest link in front-line security.

2 | What Modern Businesses Expect

Retailers no longer want three separate devices fighting for countertop space. A single terminal that accepts swipes, dips, and taps keeps the checkout lane tidy and spares staff from juggling cables or explaining why one pad is "down for maintenance." Yet the wish list runs deeper than aesthetics. A modern reader must pass the same global audits as a bank's own hardware, survive long shifts, and remain easy to fix without a specialist. The average credit card magnetic stripe reader cannot encrypt chip data, cannot store secure keys, and therefore fails the moment an auditor asks for an EMV Level 2 report.

Forward-looking merchants judge every new reader by three blunt questions:

- Does it handle every card technology?

- Magnetic stripe, IC, and RFID must live side by side so no customer is forced to dig for cash.

- Is it already certified?

- EMV L1/L2, PBOC, and CE approval prove the reader will stay legal as regulators tighten the rules. Skipping extra lab tests saves both time and fees.

- Can frontline staff keep it running?

- Swappable transports, dust-proof bezels, and clear diagnostic LEDs allow a cashier to restore service in minutes rather than box up the unit for depot repair. An idle lane costs real money.

Downtime hurts most during the lunch rush, when queues form quickly and shoppers abandon full carts. Here, modular engineering becomes an insurance policy. If a transport roller wears down, staff can lift the hood, unclip a module, and snap in a spare kept under the counter. No technician call-out, no overnight shipping, no angry tweets from customers who waited in vain. Large chains have calculated that each avoidable reader failure saves not only direct service costs but also lost basket revenue, adding up to thousands of dollars per lane per year.

In short, the bar for card acceptance hardware has moved far beyond the basic credit card magnetic stripe reader. To meet today's expectations, a countertop device must unify technologies, arrive pre-certified, and invite quick field repairs. Anything less drags merchants backward just when consumer patience - and regulator tolerance - is at its thinnest.

3 | A Safer Path Beyond Swipe-Only Devices

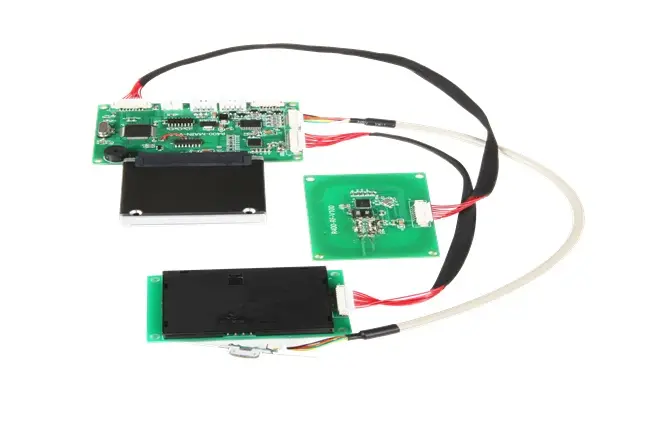

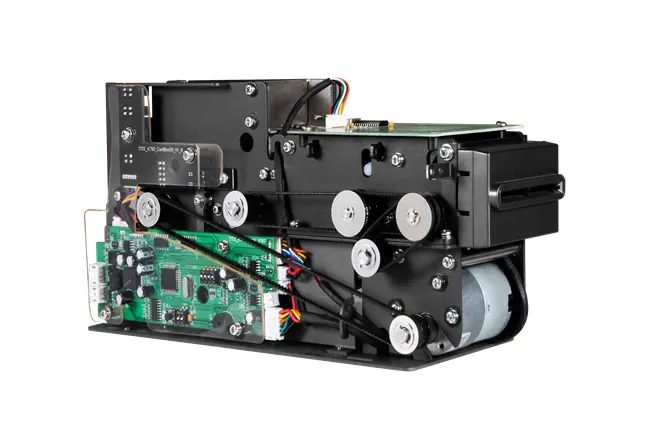

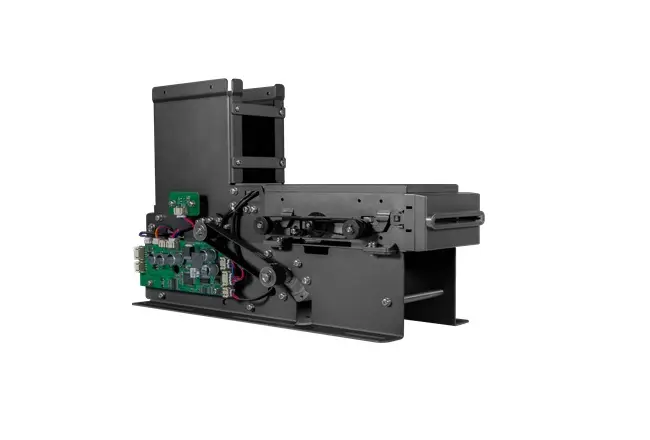

The TTCE-M800 replaces a single-purpose credit card magnetic stripe reader with a compact, future-ready engine. Three independent read heads - magnetic, IC, and RFID - share one reinforced transport built from high-temperature composite plastic and stainless-steel rails. The unit slips into the same standard kiosk cut-out as legacy readers, so most upgrades take minutes, not days.

Why the TTCE-M800 outperforms legacy readers

✅ Triple-format acceptance: One slot welcomes a quick swipe, a chip dip, or an NFC tap. A power-down-eject motor returns cards automatically during outages, preventing costly "lost-card" claims.

✅ Certified end-to-end security: Dual PSAM sockets lock encryption keys inside tamper-resistant silicon. Out-of-the-box EMV, CE, and PBOC approvals let acquirers green-light the terminal without extra lab work.

✅ Field-swappable modules: Transport rollers, sensor boards, and antennas mount on quick-release brackets. Most repairs finish on the sales floor, turning a half-day lane closure into a five-minute part swap.

✅ Industrial-grade durability: A dust-blocking bezel shields sensors from sand, paper fibres, and metal shavings. Stainless rails shrug off 50 ℃ heat, winter frost, and bus-level vibration. Daily cycles in the thousands are routine, not remarkable.

• Business impact

Merchants who deploy the TTCE-M800 cut exposure to skimming attacks, slash chargebacks, and avoid non-compliance fines. With fewer spare units and minimal technician hours, total cost of ownership drops sharply in the first year. Customers notice, too: transactions clear faster, cards never jam, and contactless lanes stay short. For any enterprise still relying on a basic credit card magnetic stripe reader, the TTCE-M800 offers a smooth, low-risk path to safer, smarter payments - without ripping out existing kiosks.

Bottom Line

Legacy credit card magnetic stripe reader technology no longer aligns with modern fraud threats or regulatory demands. Swapping swipe-only units for a reader like the TTCE-M800 delivers stronger encryption, broader card acceptance, and faster serviceability - all in one certified package. Businesses that upgrade now move ahead of compliance deadlines and show customers that their payment data receives the protection it deserves.